Why Learn How To Establish A Trust?

Establishing a trust is a fundamental step in securing your financial future and ensuring the well-being of your loved ones. Trusts are powerful legal instruments that offer a myriad of benefits, from protecting your assets and avoiding probate to providing for the seamless transfer of your wealth to future generations. However, the process of creating a trust can seem complex and daunting, often deterring individuals from ever starting. In this article, I’ll break down the concept of trusts and show you how to establish a trust.

Understanding Trusts

Understanding trusts is essential in estate planning and asset management. Trusts can be broadly categorized into two main types: implied trusts and express trusts. Implied trusts are created by the courts based on the conduct and actions of the parties involved, rather than through a written agreement. These trusts are inferred from circumstances, such as when someone holds property for the benefit of another but has not formalized the arrangement. In contrast, express trusts are intentionally established through a written trust document or agreement.

The key distinction lies in the clarity of intent. An express trust leaves no room for ambiguity, as it explicitly outlines the trust’s terms, assets, beneficiaries, and the trustee’s duties. In contrast, implied trusts rely on the understanding of the parties involved and may lack the formality of a written document.

Comprehending this differentiation is crucial, as it affects the enforceability and management of the trust, highlighting the importance of a well-drafted, legally sound trust document in achieving one’s specific goals and ensuring the seamless administration of trust assets.

Types of Trusts

Trusts come in a variety of forms, each designed to serve specific purposes and meet unique financial and estate planning needs. Knowing the different types of trusts is vital in determining which one aligns best with your objectives. Here, we’ll explore the most common types of trusts and their key features.

Revocable Living Trust

A revocable living trust is a versatile instrument that allows you to maintain control over your assets during your lifetime. You can make changes or even revoke the trust if your circumstances change. One of the primary advantages of a revocable living trust is its ability to bypass the probate process. Upon your passing, assets held in this trust can be distributed to beneficiaries quickly and privately, without the need for court involvement. This trust is a valuable tool for estate planning, enabling you to outline how your assets should be managed and distributed, especially in the event of incapacity.

Irrevocable Trust

Irrevocable trusts are designed to safeguard assets from creditors, lawsuits, and other potential threats. Once established, the terms of the trust generally cannot be altered. Certain irrevocable trusts, such as irrevocable life insurance trusts (ILITs) or qualified personal residence trusts (QPRTs), can help mitigate estate tax liability. Irrevocable trusts can be used to make tax-efficient gifts or transfers of wealth to heirs while reducing the taxable estate.

Parts of a Trust

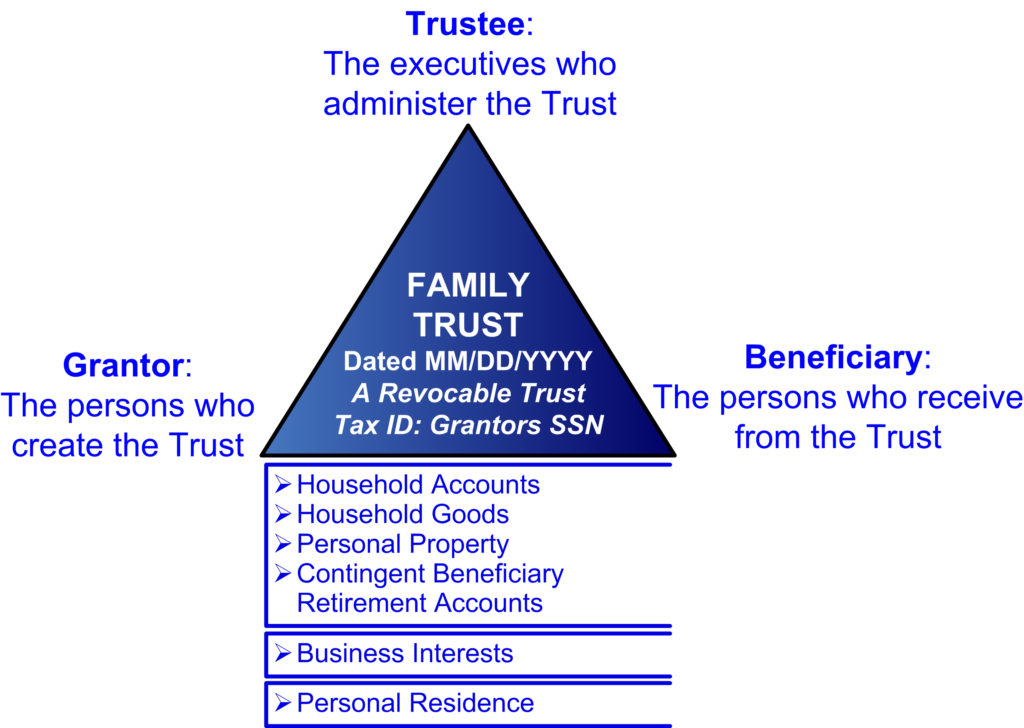

In the world of trusts, several key parties play essential roles in ensuring the trust’s successful creation and administration. At the heart of any trust is the grantor, also known as the settlor, who establishes the trust, contributes assets, and sets the trust’s terms, thereby guiding its purpose and objectives. The trustee acts as the fiduciary guardian of the trust, responsible for managing trust assets, making investment decisions, and distributing income or principal to beneficiaries, all while adhering to the grantor’s instructions.

On the other side of the trust, beneficiaries are the individuals or entities designated to receive the trust’s benefits, and their well-being is a primary focus of the trust’s existence. Additionally, in more complex trust structures, a protector may be appointed to oversee trustee actions, while advisors, such as financial experts or legal professionals, often provide guidance to ensure the trust operates efficiently.

Drafting A Trust Agreement

The process of establishing a trust involves the creation of a trust agreement, a legally binding document that outlines the rules, terms, and instructions governing the trust. Crafting a well-structured trust agreement is essential for ensuring that the trust serves its intended purpose and that the grantor’s wishes are executed accurately. Here are the key steps and considerations in drafting a trust agreement:

- Define the Trust’s Purpose and Objectives: Begin by clearly articulating the purpose of the trust and the specific objectives it should achieve. Whether it’s asset protection, estate planning, providing for beneficiaries, or charitable giving, a well-defined purpose is the cornerstone of the trust agreement.

- Identify the Parties: Specify the roles and responsibilities of the parties involved, including the grantor, trustee, beneficiaries, and any other individuals or entities with important roles in the trust.

- Detail the Trust’s Assets: Enumerate the assets that will be placed within the trust, providing a comprehensive inventory. This section should include details on how assets will be transferred into the trust and specify any special arrangements or instructions for each asset.

- Set Distribution Terms: Clearly delineate the terms and conditions under which income and principal will be distributed to beneficiaries. Be specific about the timing, frequency, and purposes for which distributions are made. If it’s a discretionary trust, provide guidance for the trustee’s discretion in distribution decisions.

- Address Trustee Powers and Duties: Outline the trustee’s powers and responsibilities, ensuring they align with the trust’s objectives and the grantor’s intentions. This may include investment authority, record-keeping, tax planning, and more.

- Stipulate Trust Duration: Indicate whether the trust is revocable or irrevocable and establish the duration of the trust. In the case of irrevocable trusts, specify any circumstances under which the trust can be modified or terminated.

- Plan for Contingencies: Anticipate potential contingencies, such as changes in beneficiaries’ circumstances, the death or incapacity of the grantor, or changes in the legal or financial landscape. The trust agreement should provide a roadmap for how these situations will be handled.

- Address Tax Implications: Incorporate provisions that address the tax implications of the trust, ensuring that it complies with relevant tax laws. Certain trusts, like Irrevocable Life Insurance Trusts (ILITs) or Qualified Personal Residence Trusts (QPRTs), have specific tax benefits that need to be considered.

- Appoint a Successor Trustee: Designate a successor trustee who will take over if the initial trustee is unable or unwilling to fulfill their duties. This ensures the continuity of trust management.

- Seek Legal and Financial Expertise: It’s highly recommended to work with an experienced attorney who specializes in trust and estate law when drafting the trust agreement. Legal professionals possess the knowledge and experience to ensure that the trust complies with all legal requirements and accurately reflects the grantor’s intentions.

- Periodic Review and Updates: The trust agreement should stipulate how and when it can be amended or updated. As circumstances change, it’s crucial to periodically review the trust to ensure it continues to align with the grantor’s goals and evolving legal and financial landscapes.

In crafting a trust agreement, precision and clarity are paramount. Each provision should be meticulously considered, and the document should reflect the grantor’s objectives while adhering to legal requirements. With the help of legal and financial professionals, individuals can ensure that their trust agreement serves as an effective tool for achieving their wealth management, estate planning, and asset protection goals. If you’d prefer my assistance with drafting a trust agreement, purchase my Legal Documentation service.

Managing a Trust

Managing a trust requires precision, diligence, and a keen understanding of the trust’s objectives. The trustee, as the primary steward of the trust, holds the crucial role of overseeing trust assets, making prudent investment decisions, and ensuring that income and principal distributions align with the trust agreement. Their fiduciary duty demands that they act in the best interests of the beneficiaries, always adhering to the grantor’s intentions.

Effective trust management involves wise financial management, thorough record-keeping, compliance with legal and tax regulations, and proactive communication with beneficiaries. Contingency planning, adaptability, and periodic reviews are essential to address changing circumstances and to keep the trust’s strategies aligned with the evolving needs of beneficiaries and the broader financial landscape.

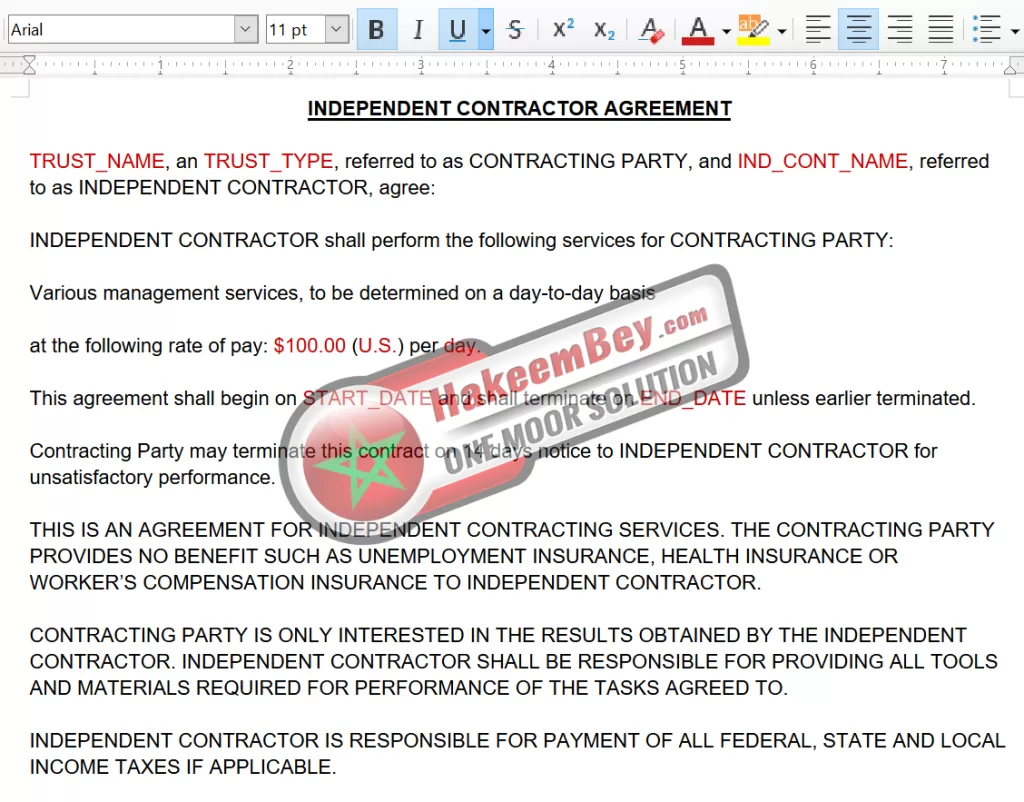

It’s highly recommended to read and comprehend Weiss’s Concise Trustee Handbook (see PDF below) to get a firm grasp of the general administration of an Express Trust. Throughout this handbook, a number of useful contracts, agreements and forms are presented as examples for you to build upon. I’ve meticulously transcribed these into editable documents called Trust Form Templates. Download them after purchase and simply fill in the blanks or replace the red text with your own information.

It should be noted that once the trust agreement is signed by all relevant parties (Grantor, Trustee and Witnesses / Notary, etc.), it is effectively established and operable unless specific clauses delay its operation. At this stage, the Trustee may apply for an EIN with the Internal Revenue Service (IRS), then use that EIN to open a bank account in the name of the trust. From there, it’s just a matter of properly managing the trust as outlined in the PDF document above.